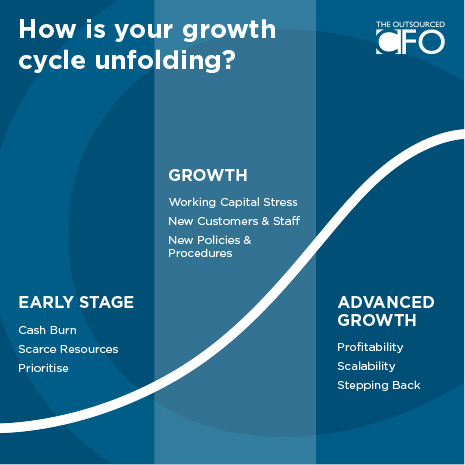

Businesses experience a range of different people, process and product challenges as they progress through the growth cycle, including;

- Cashflow and prioritising scarce resources

- Supporting growth via new markets or new offerings and;

- Finance team capability to capitalise on profitable growth opportunities

Early Stage Businesses – From Success to Stress

After some initial success, business owners have to deal with more staff, financial and client issues than they’d like. Their business is becoming more complicated with multiple causes and effects behind each problem which builds frustration and leads to stress.

Growth Businesses – Profit Doesn’t Equal Cash

As the business grows, business owners quickly become aware that improved profit does not equal improved cash. With increasing sales, cash is tied up in working capital via increased receivables and increased inventory levels, while the business owner is forking out an ever increasing salary bill as they ramp up resources to support growth and product development.

Business owners need to decide on the necessary infrastructures and investment requirement to enable more efficient growth as they explore new markets or develop new offerings.

Advanced Growth – Sustainable Growth vs Missed Opportunities

Done well, the business enjoys higher financial returns and the owner enjoys it more as their staff become less reliant on them and play a more important role in the business. Done poorly, the business misses out on higher financial returns, the business remains reliant on the owner and they’ve missed a golden opportunity.