Is a part time CFO a cost effective solution ?

A vast range of skills are required to successfully grow a small-medium sized enterprise (SME). These include Sales, Marketing, Product Development, Operations, IT, HR and Finance. Employing full time staff in these roles could cost more than $1 million per annum – simply unaffordable for most SMEs – so how do you bring in those skills?

A key member of any C-suite Executive team is the Chief Financial Officer, or CFO. The CFO is responsible for ensuring that your business is on track financially and ensuring that your staff are all aligned to a common goal usually in the form of key performance indicators, or kpi’s. A full-time CFO alone would require a package upward of $200,000 per annum, and once they are on-board keeping them challenged so that you retain their services can be difficult for a smaller enterprise. But then, do you really need a full-time CFO, or could you hire a part time CFO for a fraction of that cost and still gain all the benefits?

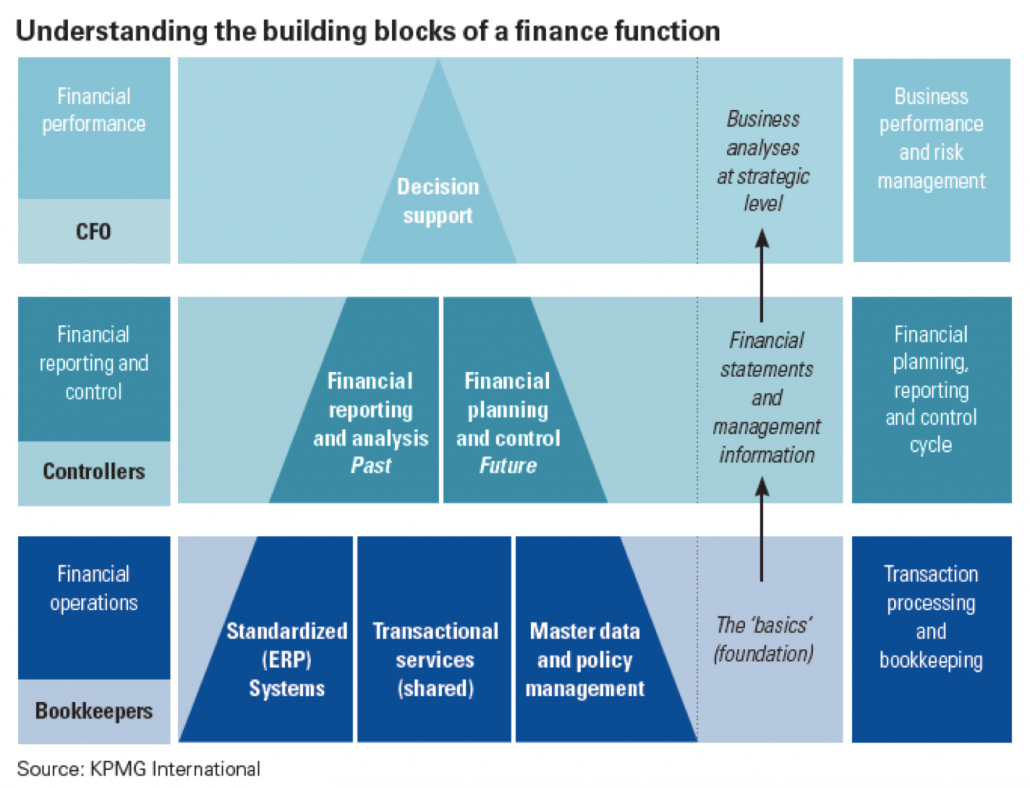

To determine if there is a better way, and if a part time CFO is a realistic option, we can look at how a finance function works. KPMG International have produced an article “Being the best – inside the intelligent finance function, insights from our latest global CFO research 2013” which defines the building blocks of a finance function as follows (see diagram):

Essentially a finance functions is built on 3 levels –

- Operational – the operational level is transactional, these tasks would be performed by bookkeepers or a small transactional team which would include accounts receivable, accounts payable and payroll.

- Financial Reporting and Control – these are Financial Controllers, Finance Managers or Accountants who rely on the transactional data maintained by Bookkeepers to perform analysis on how the business is performing. This includes analysis of historical performance and then extrapolating this data to look forward and produce forecasts of how the business is likely to perform in the future.

- Financial Performance – the CFO, who provides decision support at a strategic level.

In this model, the Bookkeeper records the transactions, the Controller will tell us how the business is likely to perform with the given metrics, but the CFO will look at how the business can change the metrics to improve business performance. This runs deeper than the financials, it looks at the whole business, how it operates and what can change to deliver improvements. Entrepreneurial business owners recognise this value but find it challenging how to acquire and afford these skills.

So in an SME, is the CFO role really a full-time role? If the business has a strong bookkeeper or even a Financial Controller and therefore has reliable transactional data and reporting, all the CFO needs to do is interpret that data and contribute to strategy. In that situation, the part time option is very workable.

In a larger business, the full-time CFO will be across many business units. This means that to an individual business unit within that larger business the CFO is effectively part time, yet to the organisation they are a full-time employee. If we adopt this scenario in an SME environment, a small business represents one of those business units, so in that context a part time CFO it’s the same thing. Instead of serving many business units, the part time CFO will serves many SME customers.

The part time CFO is a lower cost option towards gaining financial expertise in supporting strategic choices and decisions. The business can hire less costly transactional staff to ensure the reporting data is accurate and reliable. In this way, the option to hire a part time CFO to maximise its business performance can be a very cost-effective option.